From Seed to Scale: Navigating Funding Realities for Non-Mobility Climate startups

The term “climate startups” is typically associated with electric vehicles and charging infrastructure. However, electric transport solutions tackle just a fraction of global emissions (around 15%). Other areas such as agriculture, renewable energy, waste management, and sustainable consumption are also important. In this blog, we talk about the funding landscape of climate startups from sectors beyond mobility. Since the sector is new and funding momentum started only from CY 21 onwards, our analysis is based on data from the past three years.

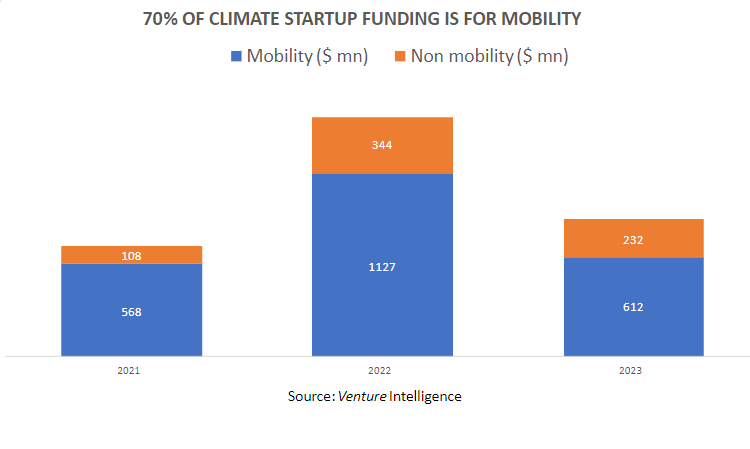

1. Non-mobility startups get only 30% of the funding, funding declined by 25% in 2023

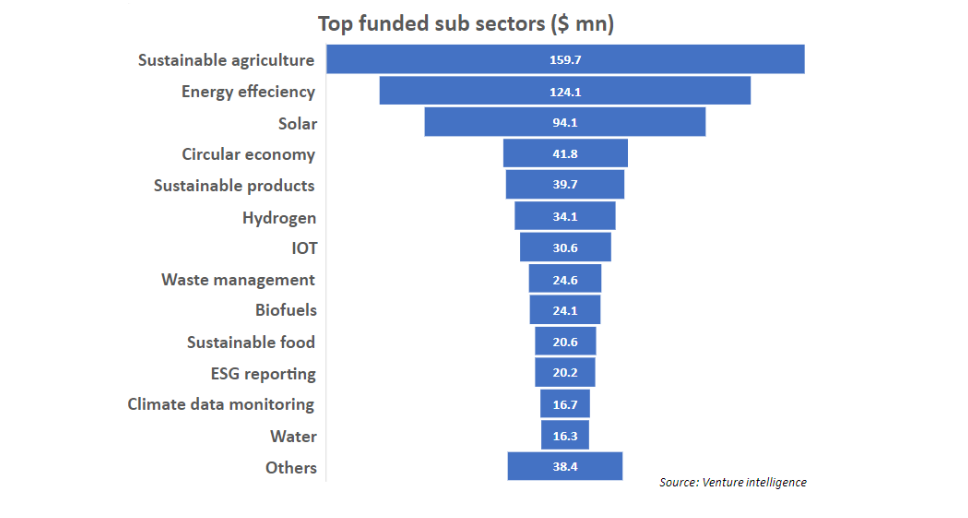

2. Sustainable agriculture and energy efficiency have received most funding, hydrogen, climate data monitoring are emerging sectors

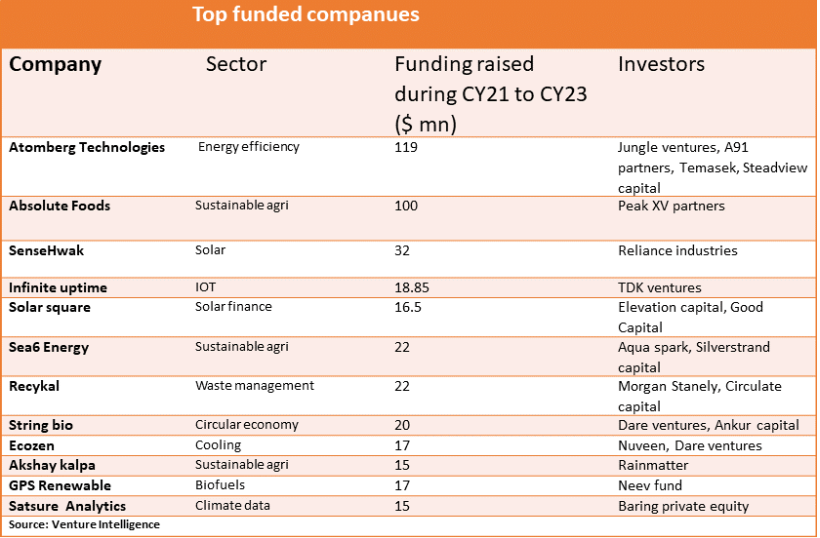

During the last three years (CY21 to CY23), the sectors that received most funding were sustainable agriculture, and energy efficiency, due to significant funding rounds for companies like Absolute Foods ($100 million) and Atomberg Technologies ($120 million).

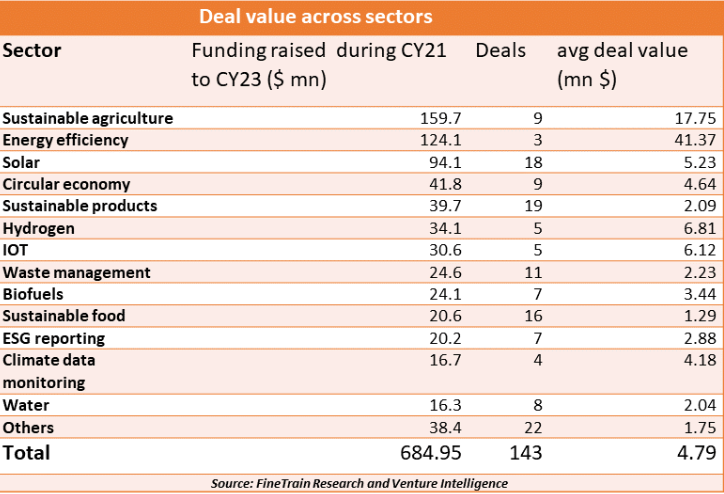

3. Average deal size is under $ 5 mn for most climate subsectors

The total funding across all sectors during the past three years is $685 million, with 143 deals and an average deal size of less than $5 million, indicating the early stage of such startups. Some sectors, like plant-based protein, ESG reporting, and water management, have even smaller average deal values, suggesting they’re in an even earlier stage of development.

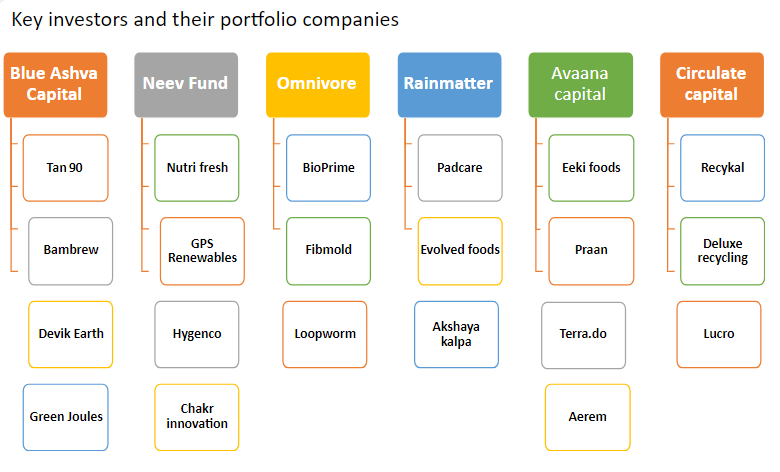

4. Only a handful of investors are actively investing in this space

Some of the most active investors include Blue Ashva, Rainmatter foundation, Neev fund and Omnivore. Except for the Neev fund, all three are early-stage investors. Additionally, Capital A, Speciale Invest, and Peak XV ventures have funded at least two companies each in the past three years.

5. Only a couple of startups have raised more than $100 mn, and just few have raised funding

beyond $15 mn

There are only a few startups that have raised multiple rounds of funding. Heartening fact is that at least one startup from each of the subsectors is present in the table below.

In conclusion, while climate startups beyond mobility are currently a small segment with few companies attaining significant scale and funding, their role in emissions reduction is critical. Recognizing these companies separately is the first step in enabling funding to them.