Beyond the Funding Dip: Highlights and Positives in India’s 2023 Climate Startup Funding

For the most part, 2023 was like any regular year for Indian climate startups – electric mobility dominated the funding news, and most deals were at the early stage. However, the total funding to the sector declined by almost 40% to $800 million USD, mirroring the funding trend across all startup genres. Seed and pre-seed stages still saw growth, but other categories faced declines (see picture below).

Hidden behind the gloomy funding news, there were lots of positive trends as well.

- Electric mobility diversified beyond two-wheelers; funding went to a few battery pack manufacturers, EV component manufacturers, and a bus manufacturing company.

- Startups across emerging sectors such as water purification, hydrogen, and climate data monitoring received funding.

- Corporate VCs played an active role.

- M&A activity picked up.

Now, let’s delve into the specifics:

Sectoral breakup:

Electric mobility

Electric mobility secured over 70% of the funding. Ather raised $108 million, and several two-wheeler startups, such as River, Raptee, Simple Energy, and Oben Electric, secured early-stage funding. Notably, the electric bus manufacturing category saw its first deal, with PMI Electro Mobility raising funds from Piramal Alternatives. Charging infrastructure providers like ChargeZone, Bolt, Exponent Energy, and Magenta secured substantial funding, while battery swapping companies faced challenges, with only Battery Smart raising a significant round. Last-mile mobility struggled, with only Zapp Electric successfully raising significant capital.

With the growing electric vehicle market, investor interest expanded across the EV hardware spectrum, including battery tech companies like Log9, Neuron Energy, and Emo Energy, EV component manufacturers such as Chara Technologies and Entuple Mobility, and battery recycling startup Batx. Additionally, several EV platform services providers, including Turno (an EV commercial vehicle marketplace), Oorja Energy (a battery design software startup), and Revfin (an EV lending startup), secured funding.

Other sectors: Solar rooftop, water, climate data monitoring and green Hydrogen

Sadly, solar rooftop is not the climate startup poster child. Solar rooftop installation has lagged behind, with the country achieving less than 25% of the targeted installation. This lag is palpable in startup funding, with only a handful of companies securing funding. Among the fortunate ones are Freyer Energy, Navitas Solar, and Prozeal Infra, who secured funding from impact investors and family offices. Additionally, Aerem, a solar financing startup, and Solar Ladder, a solar software startup, raised capital.

A few water startups such as Rite Water Solutions, Uravu Labs, and Digital Paani also raised capital from climate and impact-focused investors.

A number of weather data analytic startups such as Satsure, Satyukt Analytics and Aurassure raised capital, though they are increasingly categorized as spacetech rather than climate tech.

The sustainable products and packaging segment also saw investor interest, with Proklean (sustainable chemical) and Fibmold (sustainable packaging) raising capital.

Green Hydrogen is seeing a lot of policy push generating investor interest, a couple of Hydrogen startups raised funding-Ossus bio renewables for decentralised hydrogen production, and Newtrace promises a new electrolyser technology

ESG accounting firms faced challenges, with StepChange being the lone player to secure capital, indicating limited adoption of these products and a lack of differentiated offerings. Furthermore, fractional ownership platforms enabling retail investors to invest in sustainable assets struggled to raise significant capital.

Investor Interest:

There was a notable buzz surrounding climate startups, with many investors sharing their theses on the climate sector. Climate startup mixers were organized across the country. As if there weren’t already enough climate startup events in India, Indians also hosted climate mixers in Dubai during COP28. However, the excitement didn’t translate into deals, as investors were also looking for traction and a path to profitability, the two key buzzwords of 2023, and most climate startups don’t have enough to offer on these counts.

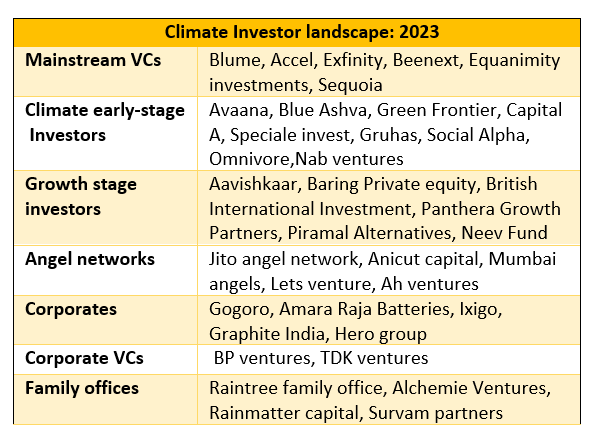

Some of the investors who made at least a couple of investments included Avaana Capital, Omnivore, Capital A, and Rainmatter Foundation. A couple of growth-stage investors, such as Baring Private Equity and British International Investments, also made a couple of investments each. Lack of interest from venture capital investors was somewhat compensated by family offices and corporate venture groups who supported their portfolio companies by providing them additional funds.

M&A Activity:

M&A activity picked up; the year started with Tube India acquiring Celestial Mobility, an electric tractor company. Later in the year, Uniqus Consultech, an ESG consulting company, acquired the ESG platform of Goodera, a CSR services provider. Vegan dairy startup One Good was acquired by Nourish You, another startup in the superfoods category. Graphite India acquired a 30% stake in Godi, a battery technology company, and Emuron Technologies, a battery swapping solutions provider, was acquired by Liv Guard Energy.

The Road Ahead:

Global forecasts suggest that the second half of 2024 will witness a surge in funding activities, due to a decline in interest rates worldwide and a renewed demand for private market assets. But then we live in strange times, in the middle of two global wars and two of the largest democracies going for elections, so let’s just keep our fingers crossed and hope alive.

In India, there are three types of investors for climate startups: venture capital investors interested in the electric vehicles segment and in breakthrough technologies in other sectors, impact-first investors looking for companies aligned to their missions, and angel networks open to all types of climate deals. The key to securing funding lies not in indiscriminately approaching every potential investor but rather in strategically identifying and connecting with those whose investment priorities align most closely with your venture.

You can download the list of climate-tech deals in 2023 here.