The State of Climate Investing in India, Mostly Execution Capital

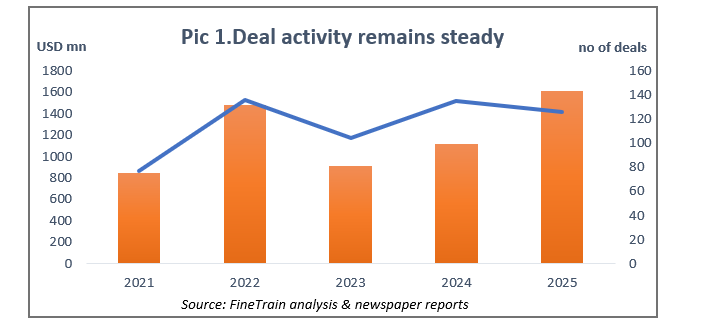

If you look only at the headline numbers, climate investing in India appears reassuringly resilient. Deal counts have held steady, total funding has rebounded after the dip in 2023, and new sectors continue to emerge. But this surface stability hides a deeper shift in how capital is behaving and what kind of climate companies India is now willing to fund. Increasingly, capital is flowing to companies that resemble infrastructure operations and can absorb $20 million or more in a single cheque.

A Barbell Market, not a Broad One

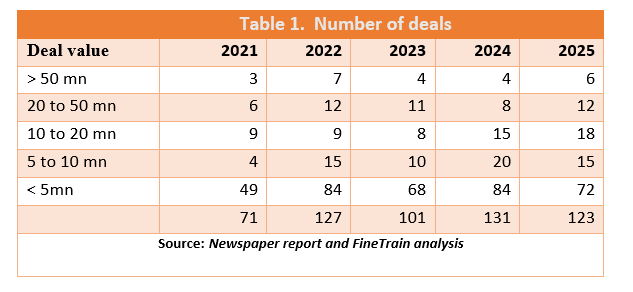

One of the clearest patterns is the quiet hollowing out of the middle of the market. In 2025, a large share of deals sit at the extremes, either below $5 million or above $50 million. Top 10 deals accounted for more than 60% of total deal value.

Deal size distribution

What is missing is sustained momentum in the middle. The $10 to $20 million and $20 to $50 million bands appear active, but they fluctuate sharply year to year instead of forming a stable growth ladder. This suggests that capital is being used in two very different ways. Early-stage funding is treated as low-cost optionality, while late-stage funding is deployed as scale capital for companies that already resemble infrastructure operators.

For founders, this creates a harsh reality. You are either expected to prove everything with very little capital or already look like a de risked execution machine before meaningful money shows up.

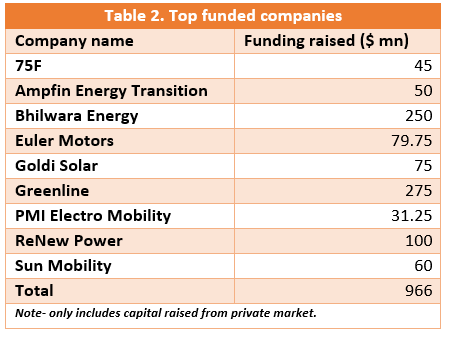

Climate investing Is Starting to Look Like Private Equity

The identity of the most funded companies tells an even more important story. The largest rounds are concentrated in power generation, logistics, fleet electrification, and energy transition platforms. These businesses are defined by assets, contracts, and throughput, not just technology or growth curves.

It would be easy to conclude that India lacks sustainability focused capital, but that would not be accurate. At the early stage, a small group of climate focused investors continues to back new companies. Funds such as Avaana Capital and Transition VC regularly write $2 to $5 million cheques into sustainability first businesses. Smaller funds like Theia and Momentum continue to support experimentation with sub $1 million bets. In that sense, early climate risk capital in India is healthier than it appears.

The real gap emerges after this stage. Between roughly $5 million and $50 million, India has very few climate focused investors willing to lead or anchor rounds. Companies that outgrow early climate funds but are not yet infrastructure scale often find themselves stranded. At that point, capital typically comes either from generalist growth investors or from private equity and strategic investors once the business becomes execution heavy. This missing middle explains why the market polarises so quickly and why climate investing in India increasingly feels like a jump from venture straight to infrastructure.

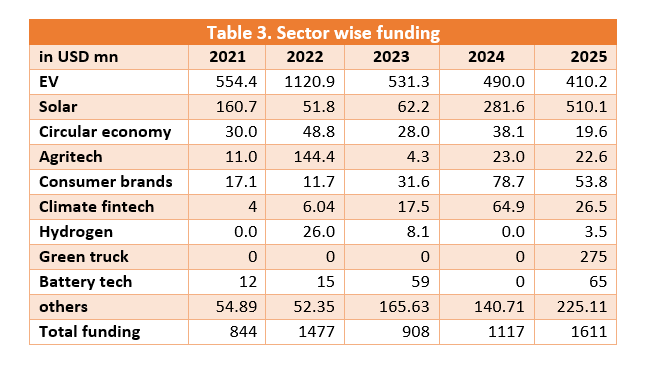

The EV Reset and the Rise of Alternative Transport Bets

Electric vehicle investment in India peaked when early OEM leaders attracted large amounts of capital. Companies such as Ather and Ola absorbed significant funding as they moved closer to maturity and public markets. As these companies graduated out of the private funding pool, a temporary gap emerged before new leaders could take their place.

Electric vehicle investment in India peaked when early OEM leaders attracted large amounts of capital. Companies such as Ather and Ola absorbed significant funding as they moved closer to maturity and public markets. As these companies graduated out of the private funding pool, a temporary gap emerged before new leaders could take their place.

At the same time, capital has shifted away from consumer EV brands toward heavy, commercial, and fleet based green transport. In 2024 and 2025, large cheques went to companies such as Greenline and Blue Energy Motors, which focus on green trucking for freight operators, as well as Eka Mobility, an electric bus manufacturer. The common thread is not EVs as a category, but transport decarbonisation where emissions impact is large, concentrated, and measurable.

Solar Is Back, and Why Storage Follows

The dominance of large cheque investors naturally favours solar, one of the few climate segments that can deploy capital at scale. Solar companies benefit from predictable long-term demand, a relatively stable policy environment, and visible public market outcomes such as Waaree Energy and Vikram Solar.

Capital has flowed across the solar value chain, including module manufacturers such as Goldi Solar, EPC players like Solar91 and Soleos Energy, and independent power producers such as Ampin Energy Transition and Bhilwara Energy.

However, rising geopolitical tensions, higher solar cell prices, and the lack of signed power purchase agreements for some newly contracted capacity could impact investor confidence in this segment going forward.

As solar capacity scales, intermittency becomes impossible to ignore. This is where energy storage enters the picture as enabling infrastructure. Early experimentation bets have been made across different storage technologies, with companies such as Viano, Sthyr Energy, and Offgrid Labs receiving early capital. However, Indian storage technology companies still need to prove competitiveness at a global scale. Commercial proof points remain limited and meaningful orders are still several years away. As a result, the next round of risk capital for this segment may be difficult to secure.

Alongside storage, there are also early bets in alternate materials linked to batteries and energy systems, including battery materials, recycling, and low carbon industrial inputs. Companies such as BRISIL, Cancrie, Dasham Labs, Climitra Carbon, Lemniscate, and Novyte’s reflect this interest, though these remain long horizon, science led investments with limited near-term commercial proof.

Climate Fintech Is Rising Because Equity Alone Is Not Enough

One of the fastest growing categories in climate investing is climate fintech. As asset heavy climate companies scale, equity capital alone is often insufficient. Working capital gaps, delayed receivables, and balance sheet pressure create demand for financing, risk assessment, and asset backed credit solutions.

Aerem, a solar financing platform, just announced a fresh capital raise of $15 million, reflecting this growing need for financial infrastructure around climate assets.

Hydrogen and Deep Tech Remain in the Waiting Room

Hydrogen and other deep climate technologies continue to appear, but without sustained momentum. This does not reflect technological failure or lack of interest. Instead, it reflects a mismatch in timing.

Investors are waiting for clearer offtake visibility, policy certainty, and price convergence before committing serious capital. Until these conditions align, these sectors are likely to remain episodic rather than scalable.

A Simple Way to Describe the Market Today

Climate investing in India now looks less like classic venture capital and more like execution oriented growth capital. Innovation has not disappeared, but the market is demanding measurable outcomes before deploying large amounts of capital. For founders, the market is sending a clear signal: either stay capital-efficient and experimental for longer, or build toward an execution model that looks credible to growth and infrastructure capital.