The State of Climate Tech Investment in India: Big Rounds In, Small Ones Vanishing

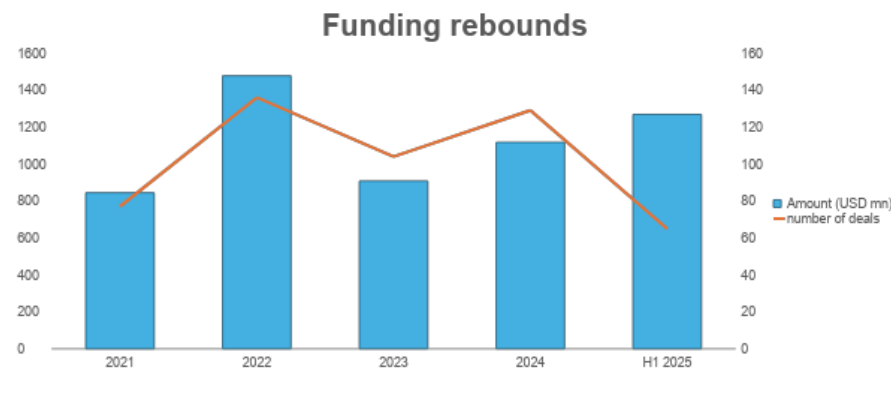

After two years of volatility, India’s climate startup ecosystem is undergoing a clear shift- there is plenty of capital for growth-stage companies, but early-stage funding is scarce. In the first half of 2025, Indian climate companies raised $1.28 billion across just 65 deals. That’s higher than the total capital raised in the whole of 2024 and more than double the H1 funding of 2024.

Most of the capital went into just a few companies. Greenline Mobility, Euler Motors, Bhilwara Energy, Goldi Solar, and Renew Power together accounted for around $800 million of the $1.28 billion total. That is over 60 percent of all private investment going to just five companies. Another 30 percent went to a handful of others such as Battery Smart, Bambrew, PMI Electro, and Ati Motors, which raised $10 million or more.

This concentration is not necessarily a bad thing. It shows that India now has climate tech companies mature enough to raise large rounds. However, it also signals a tough environment for early-stage startups. Seed to Series A capital is getting squeezed. Further, companies that have not scaled, despite having raised growth capital, are finding it hard to attract follow-on funding. The pressure is already visible, with companies like Log9 Materials, and Altigreen Propulsion Labs facing headwinds.

Solar and Mobility Dominate — But New Themes Are Emerging

In H1 2025, mobility and solar together accounted for over 80 percent of total climate tech investment. Energy storage and climate tech financing are two other emerging themes. Energy storage saw strong momentum, with companies like Ampere hour Energy, The Energy Company, Volt14, Emo Energy, and VFLow tech raising capital. A couple of climate tech financing startups, including Stride Green and Metafin cleantech, also secured funding. Beyond these, there is a long tail of companies in sectors such as sustainable packaging, industrial IoT, and carbon removal that have raised capital, but these remain exceptions rather than the norm.

Number of Investors Who Can Write Large Cheques Is Growing

There is a growing number of investors who can write cheques of $20 million plus. These include:

- Strategic investors: Hero Motors, Siemens, Havells, Essel Propack all made investments in H1 25

- Investment advisory firms like 360 One Asset and Pantomath Capital, traditionally focused on public markets, are now investing in private markets

- Family offices- such as Singularity ventures who invested in Bhilwara Energy

- Impact investors including British India Investments (BII), Leapfrog Investment, IFC, GEF capital and Nuveen

- PE firms such as Motilal private Equity who invested in Eka mobility

And Series A Is Struggling

Early-stage capital, especially Series A, is increasingly hard to access, particularly for hardware-focused climate tech companies. A few years ago, climate tech was the hot new theme and generalist early-stage investors wanted in. That momentum has cooled.

Today, generalist funds are leaning towards themes like defense tech and AI. Dedicated climate tech investors at the early stage remain limited, and many are still in the process of raising their own funds. The result is a growing gap at Series A.

Multiple factors are contributing:

- A tougher fundraising environment for early-stage climate VCs, many have been in fundraising mode for over a year. Their existing climate investments are still too early for exits, making it hard to show a performance track record

- The bar for seed investing is rising, and fewer climate tech companies can raise their first cheque unless they show revenue or strong unit economics. Products that require a green premium are struggling to gain consumer traction

One silver lining is the emergence of micro-VCs focused on climate, such as ZeCa Capital and Momentum Capital, which are writing sub-$1 million cheques. Other VCs that continue to actively invest include Avaana Capital and Transition VC.

Final Take: A Barbell Market With a Missing Middle

India’s climate startup ecosystem is maturing, with large-scale capital increasingly available for companies ready to scale. But early-stage startups are facing a funding drought, squeezed between cautious generalists and still-fundraising climate VCs.

The government’s new ₹10,000 crore Deeptech fund via SIDBI may provide some respite in H2 2025.

For now, the ecosystem is clearly barbell-shaped: big money at the top, small cheques at the bottom, and a hollowing-out middle.